Moving Averages — Responsive and Smooth Indicator

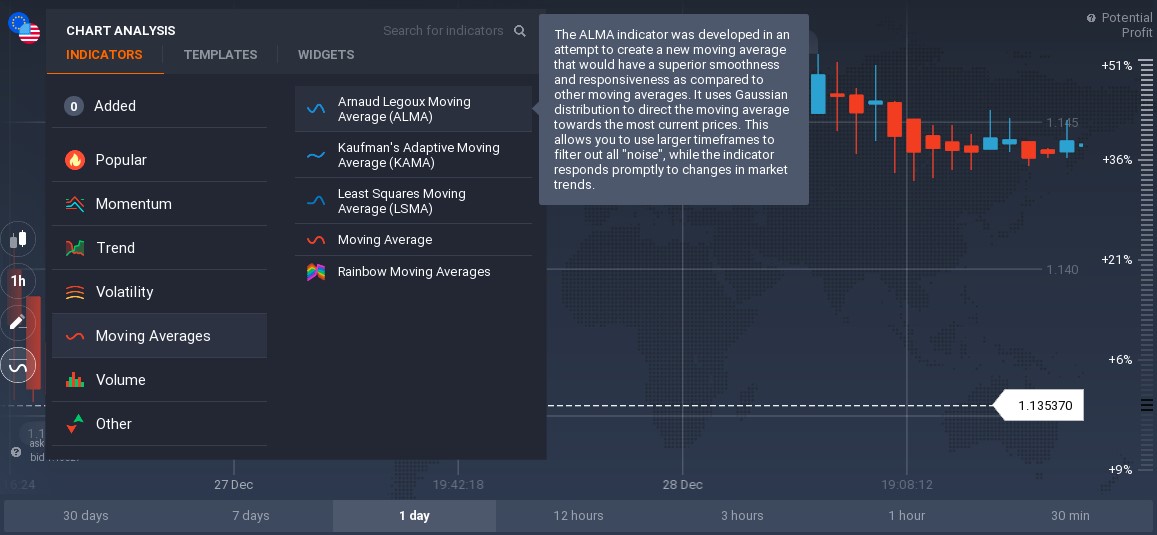

Moving averages have a reputation of an entry-level tool with limited capabilities. However, when applied correctly, they are much more complex and useful than it may seem. Today we are taking a closer look at an interesting variation of moving average that can become a valuable addition to your personal arsenal of technical analysis tools. ALMA is a relatively new indicator, that has made its first appearance as recently as 2009. It can be used for all assets and on all timeframes. It can be found in the ‘Moving Average’ tab of the ‘Indicators’ menu of the IQ Option trade room.

Why use it?

What’s the point of any moving average? To smooth out the trend line and give the trader the general idea of the trend direction and strength. But why would anyone want just another moving average, don’t we already have plenty of them? Both yes and no. There are in fact numerous MA types, each of them calculated and applied slightly differently. ALMA was designed in order to address two issues, often spotted in different MA types: smoothness and responsiveness. When using, say, a simple moving average, you may notice that the smoother it is, the longer it takes to provide a signal. It may even be that when the signal is delivered, the move you’ve been waiting for is already over. On the other hand, a shorter-term MA, while being more responsive, can appear choppy. Therefore, when using a traditional moving average, you have to choose between responsiveness and smoothness. Arnaud Legoux moving average was created with the purpose of solving this exact problem.

How to trade with ALMA?

There are several ways to apply ALMA in trading.

First, you can use ALMA as a dynamic support/resistance level. During a strong uptrend, the asset price will remain above ALMA. During a strong downtrend, the price will remain below the moving average. It is, therefore, possible to trade retracements and breakouts as with any other support and resistance tool. It is also possible to include Stochastic in the trading system in order to identify oversold and overbought positions. When two indicators work simultaneously, their signals can confirm each other.

Another way to trade using this indicator is with the help of exponential moving average (EMA). Some traders would recommend using ALMA with a period of 50 and two exponential moving averages with periods of 5 and 10. The idea behind the strategy is simple: when 5- and 10-period EMAs intersect and the asset price is above ALMA, traders consider opening a ‘BUY’ position; when 5- and 10-period EMAs intersect and the asset price is below ALMA, traders consider opening a ‘SELL’ position. But remember that no trading system can be 100% accurate.

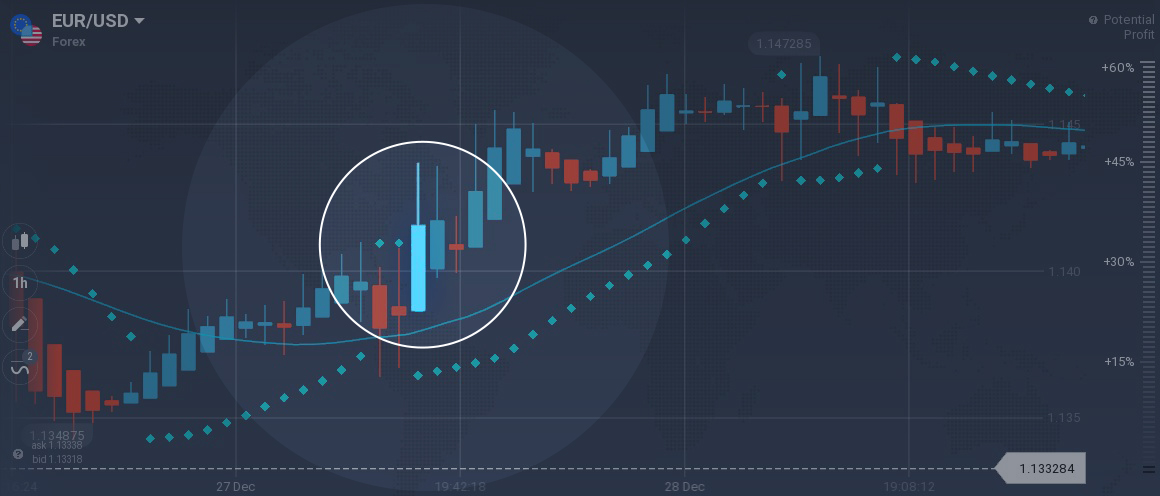

Finally, you can pair ALMA with Parabolic SAR. The most common technique when using this combination would be as follows: when the asset closing price is below ALMA and Parabolic SAR plots above the high price, traders consider opening a ‘SELL’ position. When the asset closing price is above ALMA and Parabolic SAR plots below the high price, traders consider opening a ‘BUY position. But remember that no trading system can be 100% accurate.

Note that you can come up with a trading system of your own, adding different indicators to ALMA. Just make sure to test the system on a demo account before trading on a real one.

How to set up?

This indicator can be found under the ‘Moving Average’ tab that appears when you click the ‘Indicators’ button in the bottom left corner of the screen.

ALMA has quite a few parameters to adjust. Period is the number of candles that will be used for the purposes of calculation. Source is the type of price that would be used: open, close, highest or lowest. The offset is a parameter that is used to make the curve either more responsive or smooth. Sigma is a parameter used for the filter and also has to do with responsiveness/smoothness of the line. Until stated otherwise, most strategies utilize the indicator with default parameters.

It should be noted that no moving average should be used on its own for decision-making purposes. However, they constitute an incredible complementary tool.